Source: OX Research

Authors: Carlos, Shaunda Devens

Compiled and Edited: BitpushNews

Ranger's ICO officially launched today and will continue until January 10th.

Background: Ranger is a full-stack trading terminal with three core products:

-

Ranger Perps (Perpetuals Aggregator): It is an "aggregator" for perpetual trading venues on the Solana chain, integrating top protocols like Jupiter Perps, Drift, and Flash Trade, and is currently integrating Hyperliquid.

-

Ranger Spot (Spot Aggregator): A "meta-aggregator" that routes through protocols like Jupiter and DFlow to provide users with the best price execution.

-

Ranger Earn (Yield Management): This is a newer product that offers institutional-grade, curated yield strategies to users through Ranger's Vault infrastructure.

ICO Core Details:

-

Fundraising Goal: Minimum $6 million.

-

Supply Proportion: This ICO will sell 39% of the total RNGR supply.

-

Use of Funds: Raised funds will be deposited into a treasury governed by token holders, with the team receiving only a fixed stipend of $250,000 per month.

Notably, the Ranger ICO is a significant milestone for the MetaDAO platform: it is the first token sale project on the platform to include Pre-ICO (early) investors.

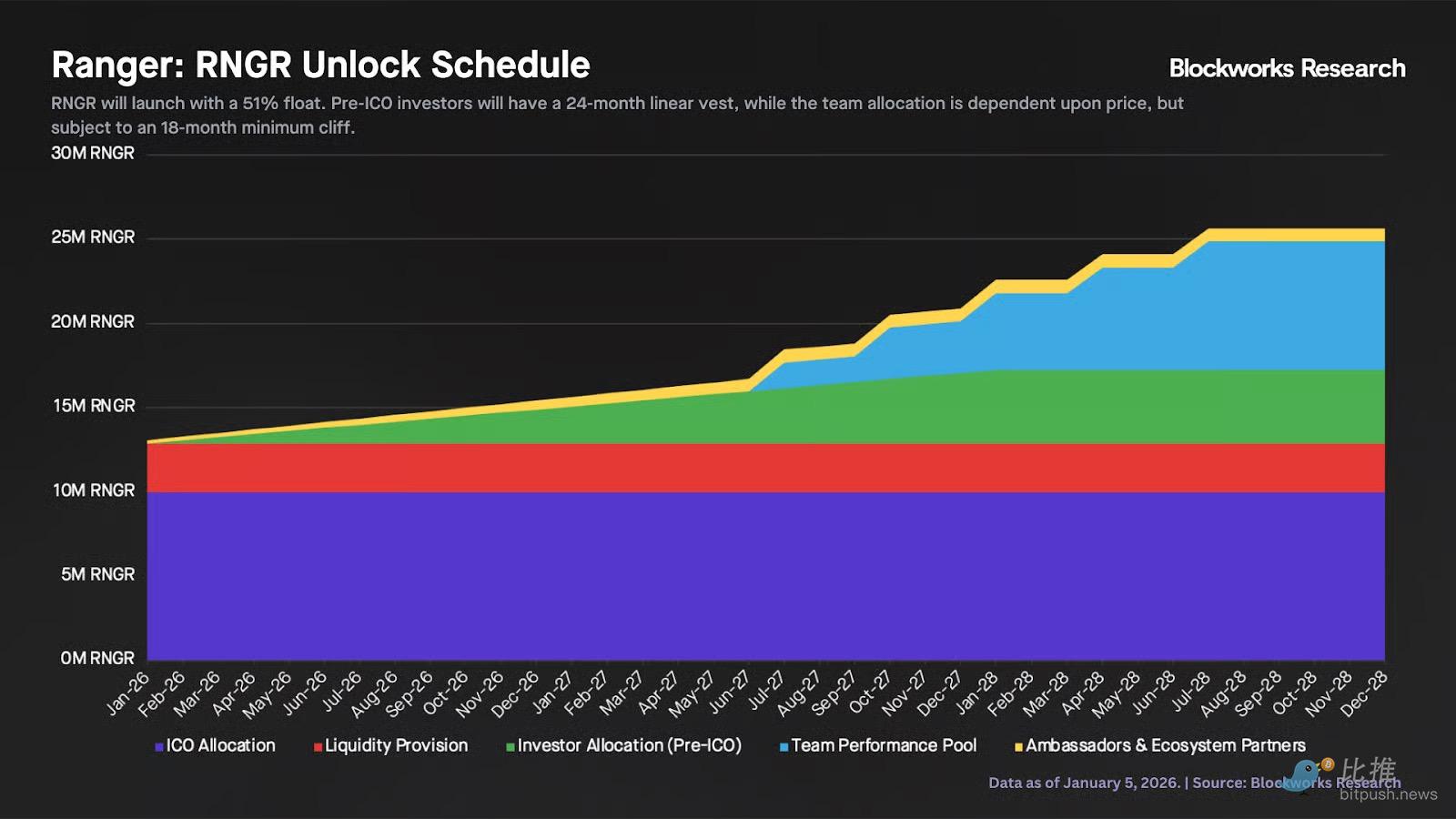

Unlocking and Alignment Mechanism:

-

ICO Participants: 100% liquid at TGE (Token Generation Event), no lock-up period.

-

Pre-ICO Investors: 24-month linear unlock, no cliff.

-

Team Allocation: The team allocation (30% of total supply, approx. 7.6 million RNGR) is fully tied to price performance. Unlocking is triggered in five tiers when the token price reaches 2x / 4x / 8x / 16x / 32x the ICO price. Each tier must maintain a 3-month Time-Weighted Average Price (TWAP) and has a minimum lock-up period of at least 18 months. This mechanism极大地 aligns the team's long-term interests with those of the holders.

Farewell to the "Whale Game": Privileges for Points Holders

Looking back at MetaDAO's past 6 ICOs, almost all were severely oversubscribed, with allocations settled pro-rata.

This mechanism明显 favored whales, as only those with extremely large capital could obtain meaningful allocations through oversubscription. Data shows that the average actual allocation ratio for past participants was only about 5% of their applied amount.

Ranger's Innovation:

Ranger has specifically reserved a fixed allocation bucket for points holders. I am very bullish on this structure: it rewards early users and contributors through subscription priority rights, rather than directly airdropping 10%-30% of the tokens like traditional airdrops (which often bring huge selling pressure). If points holders do not fully subscribe, the quota will flow back to public ICO buyers.

MetaDAO: The Leap from "Boutique" to "Assembly Line"

While Ranger itself is very attractive, I believe the bigger story lies in its significance for MetaDAO: it is a catalyst that could re-accelerate MetaDAO's launch frequency and revenue at the beginning of the year.

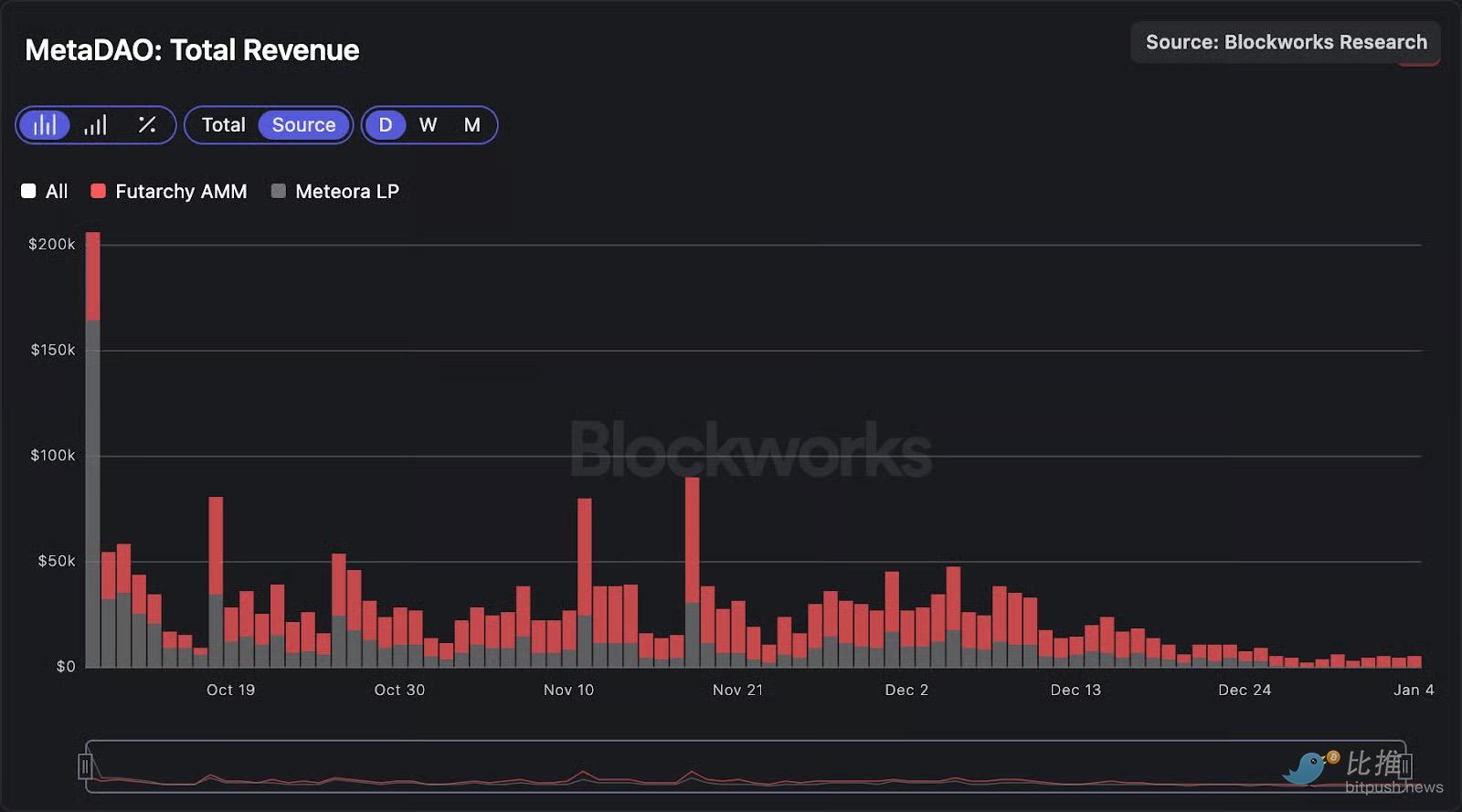

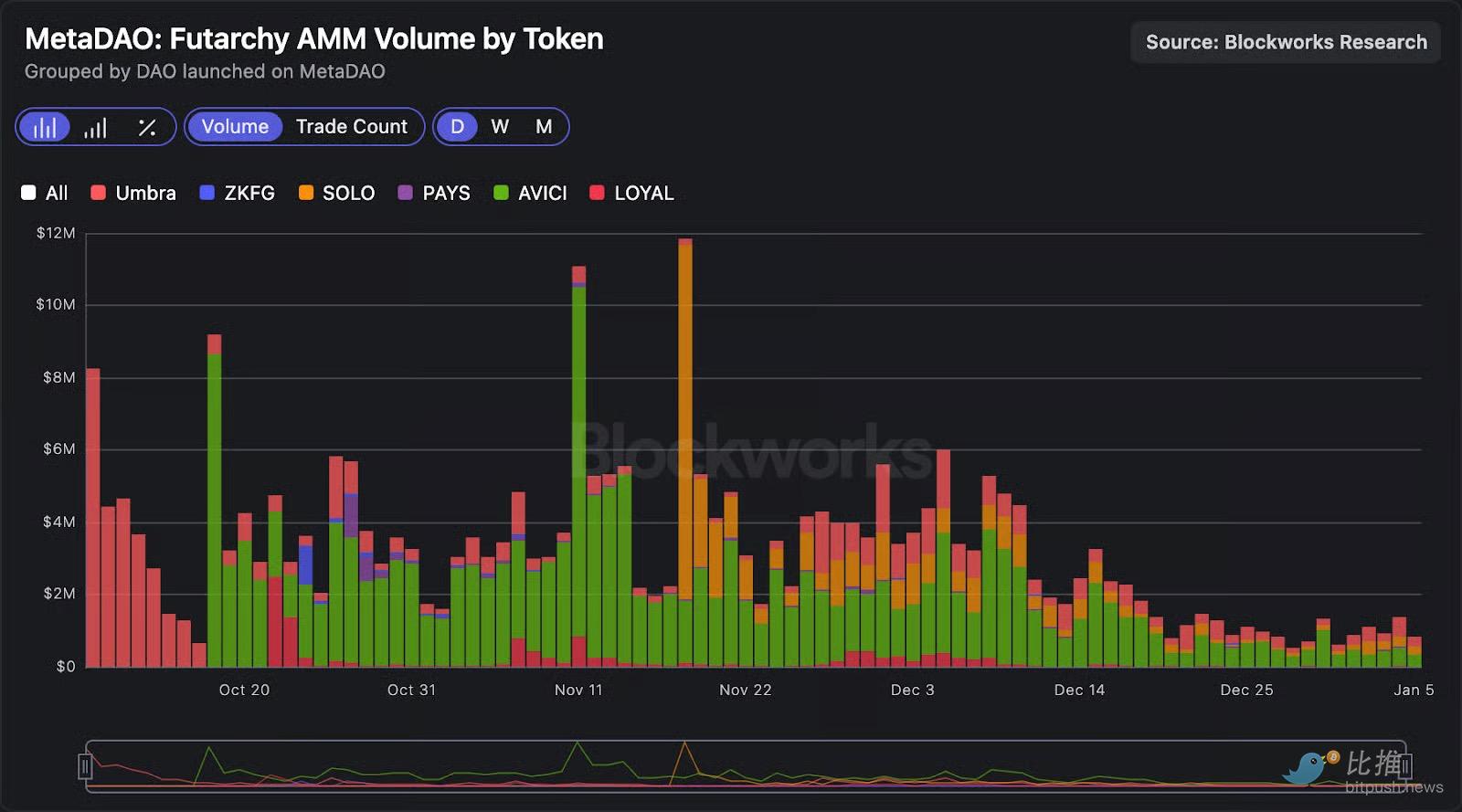

How does MetaDAO make money?

MetaDAO profits from trading fees on its Futarchy AMM and from its LP positions on Meteora.

-

Fee Adjustment: Originally, the Futarchy AMM charged a 0.5% fee, split equally between MetaDAO and the project. But starting December 28th, by mutual agreement, the full 0.5% fee now goes entirely to MetaDAO.

-

Current Revenue: Since its launch on October 10, 2025, MetaDAO has generated approximately $2.4 million in revenue (60% from the AMM, 40% from Meteora LP).

Growing Pains and Opportunities:

Since mid-December, due to the slowdown in ICO activity, MetaDAO's revenue has declined sharply. MetaDAO currently screens ICOs very strictly, placing extreme importance on founder quality and long-term alignment. While this validates product reliability, it also comes at a cost: without continuous new project launches, revenue is difficult to grow.

But the market is forward-looking. Despite the drop in daily revenue, the META token still rose about 40% last week. Although the current Price-to-Sales ratio (P/S) has risen to around 36x (previously hovering around 10-15x), I expect that as revenue re-accelerates in the coming months, the P/S will return to its historical range through "revenue growth" rather than "price decline".

Two Major Catalysts in the Coming Months

There are two major近期 catalysts that will directly boost MetaDAO's performance:

Ranger's Listing: Expected to cause severe oversubscription and drive a surge in Futarchy AMM trading volume after TGE.

Omnibus Proposal Passed: The proposal was passed last night. It will: a) migrate approximately 90% of META liquidity on Meteora to the Futarchy AMM; b) burn approximately 60,000 META (worth about $550,000 at current price). This will significantly enhance the AMM's ability to capture revenue.

Looking medium to long term, the real "10x" growth will come from:

-

Permissionless Launches: MetaDAO is discussing a shift from "full manual screening" to "permissionless experimentation." While lower-quality projects will increase, this is crucial for improving throughput and validating platform scalability.

-

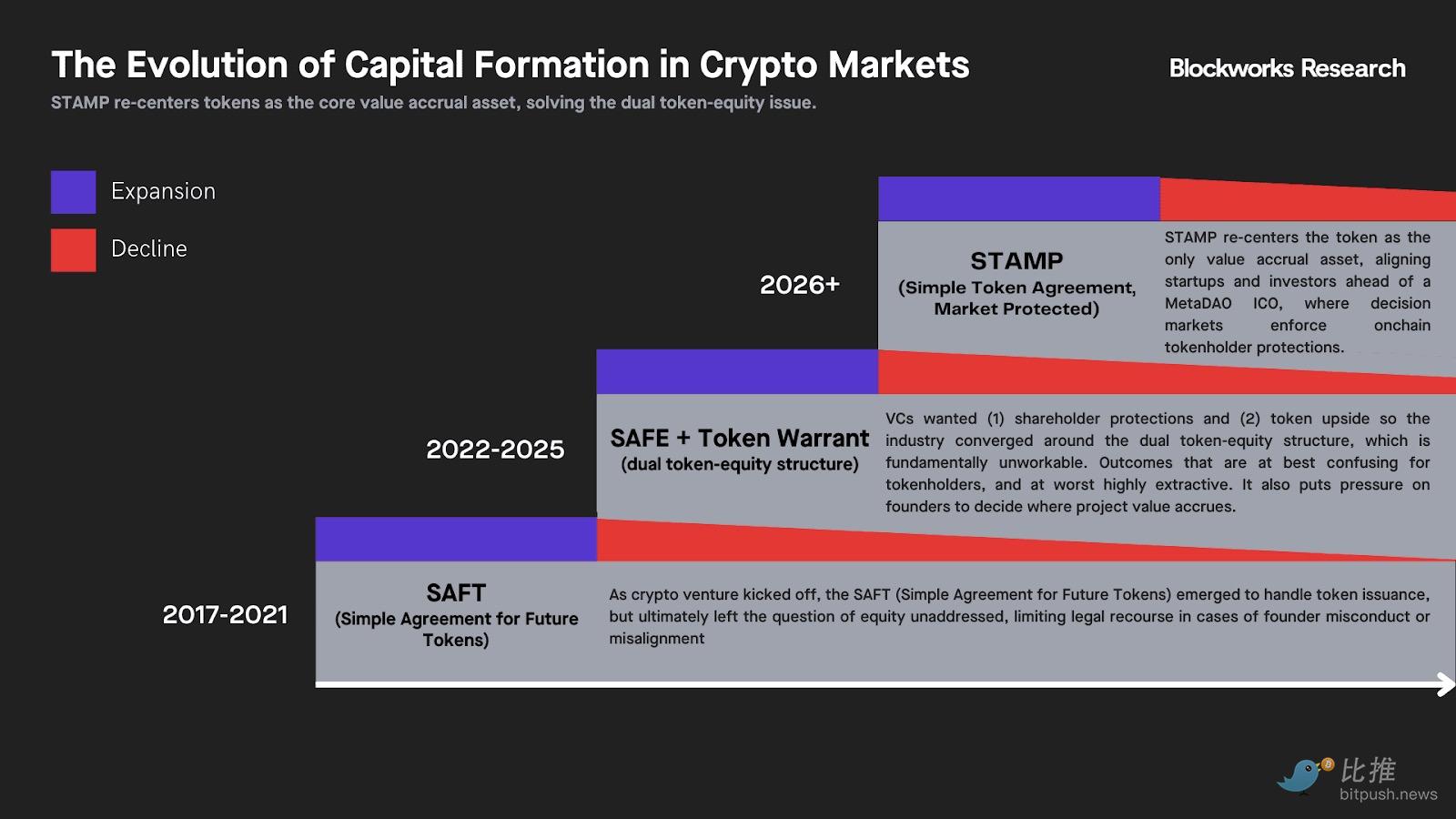

Colosseum's STAMP Program: The market is currently severely underestimating the value of this. Colosseum is Solana's entrepreneurial funnel (covering hackathons, accelerators, and venture funds). Top teams like Jito, Kamino, and Drift originated here. The STAMP program directly connects MetaDAO to this top-tier project source, ensuring a steady stream of high-quality projects.

In summary, the Ranger ICO and the Omnibus proposal will address MetaDAO's immediate needs. But what will truly enable MetaDAO's ICO frequency, trading volume, and revenue to achieve 10x growth are the upcoming "permissionless mode" and the deeply integrated ecosystem moat with Colosseum.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush